Setting up an eCommerce store can be pretty straightforward and can be done with the help of various eCommerce platforms and tools available today. But setting up an online payment gateway can get tricky with the complexities and security issues that need to be considered. This article details the best payment gateways to look for in 2015, and how to implement them in your e-commerce store to simplify online payments.

Handling an eCommerce store is not a walk in the park. You need to manage things on multiple fronts to actually create a successful online store. There are various eCommerce modules that need to be given priority, right from inventory, order management and to the most critical module that accepts online payments.

With multiple e-commerce platforms, there are also many complexities involved in payment processing which needs to be simplified. You might be looking for solving confusing questions like

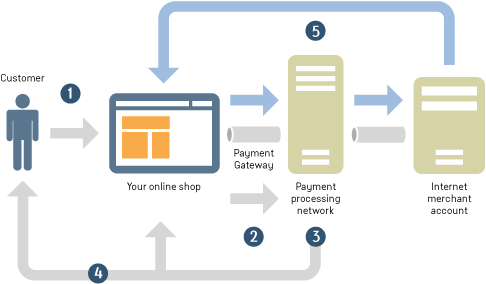

A payment gateway is required to process any credit and/or debit card transactions made through your eStore. It is a middle layer interfacing between the eCommerce store and your merchant account. Several simple payment service providers combine payment gateways and merchant accounts, which makes things easier but limits the flexibility for payment options.

Let’s take a look at the top three online payment gateway service providers for 2015. We’ve done intensive research for you, but feel free to get back to us for helping you choose an ideal payment gateway.

1.PayPal

PayPal is one of the most recommended payment gateway providers for an eCommerce retail store. It offers products like web payments, mobile payments, and online invoicing.

Pros:

2. Authorize.net

2CheckOut – accepts global payments online with hosted checkout and API options.

Pros:

Handling an eCommerce store is not a walk in the park. You need to manage things on multiple fronts to actually create a successful online store. There are various eCommerce modules that need to be given priority, right from inventory, order management and to the most critical module that accepts online payments.

With multiple e-commerce platforms, there are also many complexities involved in payment processing which needs to be simplified. You might be looking for solving confusing questions like

- Which payment gateway is ideal for my eCommerce store?

- Which are the top mobile payment gateway providers?

- How to integrate payment gateway?

Why Do I Need A Payment Gateway?

Payment Gateway Integration Process

Let’s take a look at the top three online payment gateway service providers for 2015. We’ve done intensive research for you, but feel free to get back to us for helping you choose an ideal payment gateway.

1.PayPal

PayPal is one of the most recommended payment gateway providers for an eCommerce retail store. It offers products like web payments, mobile payments, and online invoicing.

Pros:

- Accepts Credit, Debit Cards and PayPal

- Doesn’t require a merchant account

- No SSL Certificate required

- Available in more than 190 countries

- No monthly fee, Reasonable transaction rate: 1.9% – 2.9% + 30 cents per transaction + 3.9% transaction fee + a fixed fee for international sales

2. Authorize.net

Authorize.net is another popular gateway provider.

Pros:

- Supports mobile payments, recurring billing, in-form payments

- Accepts payments directly through the Authorize.net

- PCI compliant, making it easy to obtain SSL certificate

- High fees: $99 + $20 including setup and maintenance cost

- To process international payments your business must be operational in first world countries like US, Canada, UK, Europe and Australia

- Requires a merchant account

- Doesn’t offer volume discounts

2CheckOut – accepts global payments online with hosted checkout and API options.

Pros:

- Processes major online payment methods

- Supports mobile payment

- Don’t need a separate merchant account

- Present in over 200 countries

- No monthly fees or hidden fees

- High transaction fee: 5.5% per transaction + 45¢

- Doesn’t offer volume discounts

- No hosted checkout page

No comments:

Post a Comment